2023 is proving to be a big year for Bitcoin. Despite an overall down market since April 2022, Bitcoin experienced a surge of excitement and optimism in the first half of 2023 with many of the more promising events revolving around Bitcoin Ordinals.

Here’s an overview of how Ordinals are shaking up the today's Bitcoin world and the potential they have for even more innovation on Bitcoin.

How Bitcoin Ordinals Work

Bitcoin Ordinal theory is a numbering system that assigns values to each individual Bitcoin satoshi (the smallest unit of Bitcoin). With numbered sats, inscriptions can then be made on a specific sat. These inscriptions are collections of arbitrary data and metadata that can be in almost any format and inscribed directly on the Bitcoin blockchain.

This process of inscribing Ordinals makes them similar to NFTs in the sense that they become unique with inscribed data (though they are considered more so digital artifacts). The Bitcoin upgrades SegWit and Taproot, which increased block size among other things, made Ordinal inscriptions possible.

The Speed at Which Ordinals and Ordinal NFTs Took Off

Ordinal theory was created by Casey Rodarmor and launched at the end of 2022. But the project really took off in February of 2023. By then, Yuga Labs — creator of the wildly popular Bored Ape Yacht Club — announced its first Bitcoin NFT collection using Ordinal inscriptions.

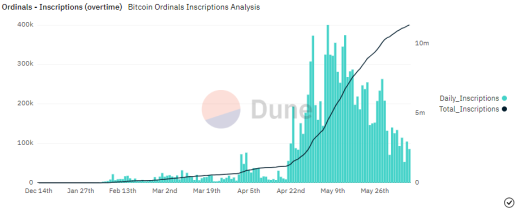

Bitcoin transactions shot up and so did Ordinal inscriptions. By the beginning of June, more than 11 million Ordinals were inscribed on Bitcoin. The peak for inscription volume was in the middle of May, but the popularity didn’t completely wane.

Source: Dune

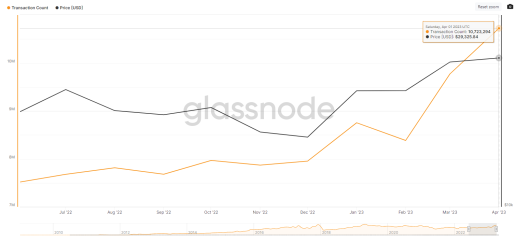

Coinciding with Ordinals excitement, Bitcoin network activity also surged. Transaction volume shot up, reaching tens of millions of transactions per day in March and April. And total Bitcoin fees for ordinals reached $44,792,565 in June.

Source: Glassnode

New Developments for Ordinals

Like most novel projects in crypto, Ordinals had a huge spike in interest and hype. But interest tapered, though it didn’t completely dissipate. But then BRC-20 and BRC-721 tokens came along and kept the fascination high.

As people realized the possibilities of these new developments on the Bitcoin blockchain, ideas sprouted from one another. After BRC-20 came BRC-721.

The Token Standard of BRC-20 and Ordinals on Bitcoin

Ordinals caused a stir in the community, sparking old discussions about network congestion and the best uses for Bitcoin. But it didn’t stop at Ordinals. Next came the BRC-20 token standard. This new “token standard” was created in March 2023 and named in homage to Ethereum’s ERC-20 token.

BRC-20 tokens are a bit different from other token standards in that they’re not fully fledged standards or parameters. BRC-20 tokens are actually a bit of JSON code inscribed in an Ordinal. Their purpose is to create semi-fungible tokens on the Bitcoin blockchain. In this aspect, they are similar to ERC-20 tokens.

Users can deploy, mint, and transfer BRC0-20 tokens using the parameters inscribed in the Ordinal. Domo, who created BRC-20, minted the first BRC-20 coin under the ticker ORDI in March of 2023.

What is BRC-721E and what does it introduce to Bitcoin?

The BRC-721E token standard, like Ethereum’s ERC-721 was created for NFTs. But instead of simply inscribing Ordinals as NFTs, ERC-721 allows users to bridge traditional NFTs from Ethereum to Bitcoin.

BRC-721E tokens are created when a user bridges NFTs from Ethereum by sending them to a burn address. Once they teleburn the ERC-20 token, metadata is inscribed on with a low res version of the NFT. The inscription also references the burned ERC-20 token with the full-quality NFT.

Currently, new NFTs bridged to Bitcoin automatically appear on a custom Ordinals market collection page with complete metadata. One important aspect of BRC-721E tokens is that bridging them is permanent and cannot be undone.

What’s Next for BTC Ordinals and Bitcoin NFTs?

As with many new developments in the crypto world, some of the best ideas start as a meme. BRC-20 tokens kicked off memecoin season on Bitcoin and some of the NFTs getting bridged from Ethereum are as silly as one might expect. But beyond the hype, fun, and aping in, these new ideas are opening the world to all these new developments on Bitcoin.

For years, Bitcoin has been viewed as a cryptocurrency that holds value, but has little use beyond that. The new use cases that have come from the Bitcoin Ordinals protocol are promising developments. They’re also creating demand for Bitcoin layer 2 solutions.

Bitcoin Layers: How do they Factor Into BTC Ordinals?

With increased transaction size and volume, critics of Ordinals have claimed that Ordinals are clogging up the Bitcoin network with arbitrary and useless data. But layer 2 solutions like the Lightning Network (LN) can solve this.

Because of the popularity of Ordinals and BRC-20 tokens, exchanges like Binance and Coinbase are swiftly moving toward Lightning integration. These are positive developments for the Bitcoin ecosystem which is growing more versatile every day.

The Lightning Network still relies on significant on-chain block space. But it allows a greater number of BRC-20 transactions to be settled off-chain and then verified in batches through an open Lightning channel on the blockchain. This vastly relieves congestion on the network.

Ordinal Inscriptions and the Future of the Bitcoin Community

With one simple idea to create a numbering system for satoshis, the Ordinals protocol has sparked a whole new sector on the Bitcoin blockchain. Many skeptics claimed nothing interesting would ever happen on Bitcoin, but that claim has already been disproven as Bitcoin has been at the center of crypto excitement this year.

In the past, the biggest thrill in Bitcoin involved market price surges. But now, there are new possibilities for applications, uses, cross-chain transactions, and a kind of innovation that will drive efficiency. With greater demand for more Bitcoin products, layer 2s and other scaling solutions will become more efficient. The story of the oldest blockchain in the world is only beginning.