If you've been paying attention to the crypto scene lately (particularly within the Bitcoin community), you've probably heard about BRC-20 tokens and even read about them.

But at this point, you probably also have one key question in mind: how does the BRC-20 standard work compared to ERC-20?

It's a question that has become very common as the adoption of BRC-20 tokens rises. In this blog post, we’ll explore the difference between BRC-20 tokens and ERC-20 tokens.

What is a Token Standard?

Token standards are sets of rules and parameters that govern how a token works on a blockchain. With a common standard, users can create, manage, and use new tokens in a consistent way.

Some things that token standards create guidelines for are:

- Creating new tokens

- Transferring tokens between addresses

- Checking token balances

- Approving token transfers

- The required data structures, interfaces, and methods

Token standards help developers create tokens and smart contracts that are able to interact with each other.

How Does the ERC-20 Standard Work?

The ERC-20 token standard on the Ethereum blockchain is the most widely used token standard (it stands for Ethereum Request for Comments 20) and is the technical standard for all Ethereum-based assets. The ERC-20 standard was the 20th proposal submitted — and it was accepted.

ERC-20 defines:

- Token balance: how the Ethereum network documents and tracks wallet balances

- Transfer function: how tokens are sent between wallet addresses, verifying the sender has sufficient funds

- Token supply: how many tokens exist and whether they can be minted or burned

- Token metadata: information about the token’s name, symbol, and number of decimal places to display

- Approval and allowance: parameters allowing certain wallet addresses to spend tokens on a user’s behalf

- Events: allowing tokens to emit events on the blockchain that can be captured and used by other smart contracts or applications

- Interface: a common interface for tokens to standardize interactions between contracts and applications

While ERC-20 tokens are the most used, there are other token standards. ERC-721 tokens are Ethereum’s non-fungible tokens (NFTs). Other blockchains also have their own standards like TRC-20 on the Tron network and BEP-20 on Binance Smart Chain.

How Do BRC-20 Tokens Work?

Ultimately, BRC-20 is an experimental token standard that allows users to mint and transfer fungible tokens on the Bitcoin blockchain using the Ordinals protocol. As such, it has a unique way of being deployed and limited parameters.

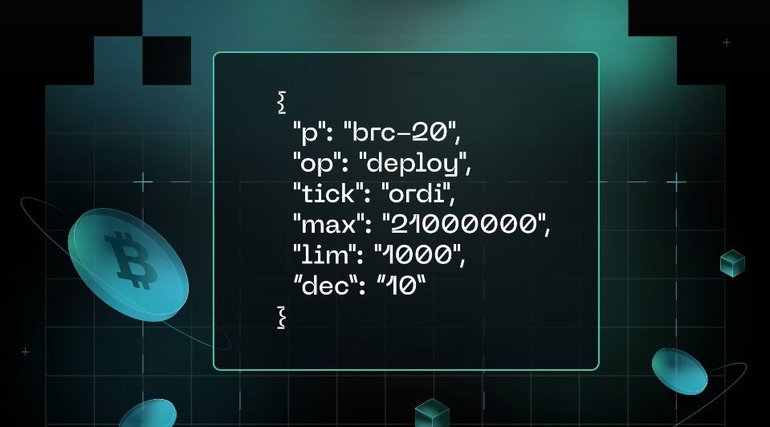

To mint BRC-20 tokens, users inscribe Bitcoin Ordinals with some JSON text that defines the token. The text has some simple variables and functions like a 4-character ticker. It also includes a max supply number, token limit per mint, and deploying, minting, and transferring functions.

A BRC-20 Ordinal inscription looks something like this:

BRC-20 uses a "first-in-first-out" model, meaning the first person to deploy a token owns that token. So when Domo, the pseudonymous on-chain analyst who created the first BRC-20 token deployed Ordis, he claimed ownership of it.

Once someone deploys a BRC-20 token, anyone can mint them. After tokens are minted, users can transfer tokens between Bitcoin wallets.

What’s the Difference Between BRC-20 and ERC-20?

The most obvious difference between BRC-20 tokens and ERC-20 tokens is the underlying blockchain — Bitcoin versus Ethereum. Beyond that, there are several distinctions.

A comparison chart differentiating between ERC-20 and BRC-20 token standards.

Source: Trust Machines.

Despite having a similar, tongue-in-cheek name, the Bitcoin Request for Comment 20 standard is fundamentally different from ERC-20, especially given the relation between BRC-20 tokens and Ordinals.

Bitcoin Memecoin Hype and Debates

Likely, there are still undiscovered use cases for BRO-20 and other token standards on Bitcoin. But as often happens in crypto, the root of many developments is memes. In 2023, memecoin season began and BRC-20 tokens like Ordi and Pepe shot up in popularity.

The memecoin hype has led many people to dismiss BRC-20 tokens, and it’s true that even the BRC-20 inverter himself said the new Bitcoin token standard is only a fun experiment. But those who have been waiting for more functionality on Bitcoin see this as only the first step toward unimagined new possibilities.

Bitcoin Network Congestion, Fees, and Transaction Scalability

And as you can imagine, the BRC-20 craze has also created a massive influx into Bitcoin network, which has led to concerns about network congestion (similar to what happened with Ordinals and inscriptions). In April and May 2023, Ordinal inscriptions reached all-time-highs, and BRC-20 transactions accounted for more than 50% of on-chain transactions.

Source: BeInCrypto

This network activity has led to the recent spike in Bitcoin’s high fees. Users in places like El Salvador report on crypto Twitter that transaction fees close to $20 for a $100 transaction.

However, proponents of BRC-20 have also pointed out that Bitcoin is continuing to innovate, and there are possible transaction scalability solutions like Segregated Witness (SegWit), Taproot network upgrades and the Lightning Network that could ultimately address many of these issues.

Ordinals, Inscriptions and BRC-20 are Advancing the Bitcoin Ecosystem

Every new Bitcoin idea that moves the world’s dominant blockchain forward opens new possibilities. Today, most of the excitement is in memecoins and trying new kinds of Ordinal inscriptions, but what may start as a fun experiment today could lead to critical innovation tomorrow.

BRC-20 is a perfect example of this. Not only is the development notable because its the first token standard on the Bitcoin network, the new token standard has had a huge impact on the Bitcoin ecosystem in such a short time much like its predecessor, the Ordinals protocol, which facilitated the creation of Bitcoin NFTs and caused network activity to jump.

Some dislike the increased “network bloat” created by Ordinals and BRC-20 tokens. Others, however, are excited about the new potential being unlocked, as minting more tokens compatible with the Bitcoin blockchain does open new possibilities.

In a recent interview, famed Bitcoin investor Michael Saylor said, “What happened with ordinals and NFTs is we crossed this chasm from what was a bearish scenario to a bullish scenario. If I were a miner, I would be ecstatic.”

So while the BRC-20 ecosystem is still in its infancy compared to its ERC-20 counterpart, the new tokens on Bitcoin it allows users to create could, ultimately, evolve to make BRC-20 a token standard that enables much more.