By this point in our 'Not Your Ordinary NFTs: An Exploration of Bitcoin Ordinals' series, we've laid out multiple use cases for the Ordinals protocol and how they have affected the Bitcoin community. From Bitcoin NFTs to Ordinals wallets and the NFT market, this creation by Casey Rodarmor has convinced many that Bitcoin isn't simply a token but that there is a broader Bitcoin economy ready to be unlocked.

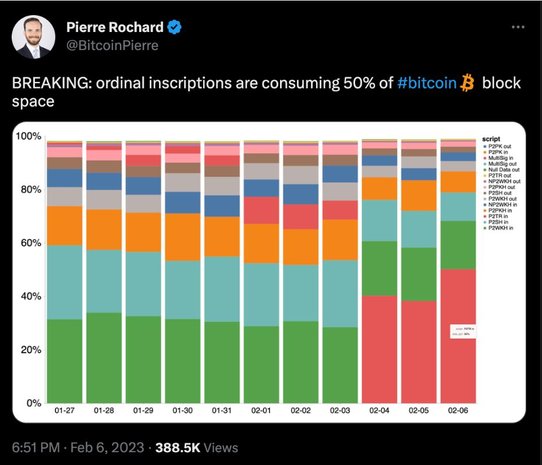

Our last entry specifically discussed how the Ordinals project has revived the Bitcoin block size and space debate, given how much space is needed on-chain for Bitcoin inscriptions to happen. In our mind, this was an important debate to highlight given one big milestone set to happen for the Bitcoin blockchain next year: a Bitcoin halving event.

What is Bitcoin Halving and How Does it Impact the Bitcoin Network?

“The halvening,” as it is sometimes called, occurs when the amount of Bitcoins entering circulation every ten minutes is cut in half, as well as block rewards for miners.

This Bitcoin mining milestone happens every 210,000 blocks, with the most recent “halvening” happened in May 2020 when the Bitcoin block reward dropped to 6.25 from 12.5. The next will occur in 2024.

The “block reward” refers to the Bitcoin rewarded to a miner when they successfully validate a new block. This means that after every “halvening,” there is less treasure to be shared among miners, thus increasing competition to validate blocks.

Therefore, this event is seen as a major milestone because it is a function of supply and demand. New bitcoins entering circulation over a given period of time are cut in half, while demand theoretically remains the same.

Lower supply paired with equal (if not higher) Bitcoin demand should result in higher Bitcoin prices, further increasing competition among miners. However as we discussed above, miners will be fighting for smaller and smaller pieces of the overall Bitcoin pie.

What are Bitcoin Ordinals and Ordinal NFT Inscriptions?

The next Bitcoin “halvening” will be unique because it will be the first to occur alongside the existence of Bitcoin Ordinals.

Bitcoin Ordinal theory refers to a protocol that allows each individual satoshi – the smallest unit of bitcoin – to be identified and tracked according to the order in which it was mined. This numbering system allows individual satoshi to be tracked as unique assets.

Because of this new system, these “Ordinal” satoshis can now contain “inscriptions,” or content types embedded in each individual satoshi’s hexadecimal data thanks to both the Taproot and SegWit developments on the Bitcoin chain. You can learn more about inscriptions here and how digital artifacts differ from the NFTs you might normally see on the Ethereum blockchain, which utilize smart contracts.

How Ordinal NFTs Have Affected the Broader Bitcoin Mining Economy

By their nature, inscribed Ordinals are larger files than non-inscribed satoshis, and therefore take up more block space. They have a lower time preference than non-inscribed transactions because they are not purely financial in nature, and are therefore more likely to be settled when block fees are at their lowest.

For example, a large institutional body such as a custodial service looking to settle a large Bitcoin transaction for a user is unlikely to be willing to wait beyond a mempool depth of more than a couple blocks. In contrast, a user minting an NFT via Ordinal inscription can afford, in terms of time preference, a much larger block depth.

This is a huge development for miners, who now have an entire class of transactions acting as a buyer of last resort. As Bitcoin Ordinals and inscription transactions increase in popularity, the higher the price floor of transaction fees becomes. This has the knock-on effect of driving transaction fees higher at the high time preference end of the mempool, further rewarding miners for their efforts.

And make no mistake, Ordinal inscriptions became very popular, very quickly.

In a recent whitepaper by crypto research firm Galaxy Digital, it was estimated that Ordinals could account for an additional 330 BTC earned by miners if inscriptions used only underutilized block space. That alone would represent a 6.1% increase on what was earned by miners in 2022.

How Bitcoin Ordinals Could Affect the Next 'Halvening'

By their inherent nature and thanks to their increasing popularity helping to drive transaction fees higher, Bitcoin Ordinal inscriptions are a godsend for Bitcoin miners who may be apprehensive of the next “halvening.”

During the near term, this protocol may not fully offset the decreased block reward that comes with every halvening. In the current environment, miners do not rely on transaction fees for the majority of their expected reward.

In the long term, however, Ordinals could flip this dynamic on its head completely. As one of the most exciting developments in years for those looking to build directly on the Bitcoin base layer, Ordinals and inscribed sats have completely reignited the Bitcoin NFT marketplace. Given that inscriptions need more block space when inscribing content onto the Bitcoin chain, proponents of the protocol have argued that the rise in transaction fees we've seen thanks to Ordinals could actually carry over into the long-term.

In other words, miners could very well end up making more thanks to transaction fees, and the latter could become more of a factor in incentivizing miners to keep mining blocks, even as their block rewards are cut in half during the next "halvening."

Ordinals and the Future of Bitcoin: Beyond NFTs on Bitcoin

As a vehicle that promises to increase Bitcoin’s scope, transaction demand, and transaction price floor, it’s not far-fetched to say that by Bitcoin’s next predicted halving in 2024, Ordinals could significantly offset the negative impact on miners.

It's a possibility that goes to show how the Ordinals protocol hasn't just affected the Bitcoin ecosystem and motivated Bitcoin core developers, it has made Bitcoin history by also motivating us to reconsider what we knew about the very infrastructure around Bitcoin itself.